Multifamily asking rents slipped in September, according to the latest rent growth report from CoStar.

The national average asking rent fell to $1,712, a 0.3 percent drop from August’s revised average of $1,717. This marked the third straight month of flat or falling rents and the steepest September decline in over 15 years.

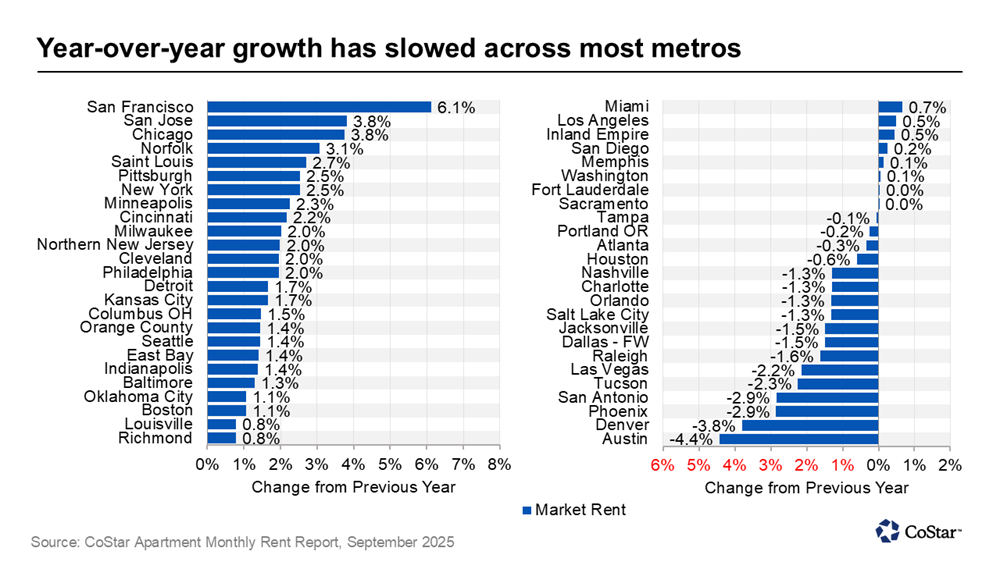

Year-over-year rent growth continues to stall around the 1-percent mark, where it has hovered for nearly two years. Annual rent growth decelerated slightly to 0.9 percent.

Midwest and Northeast regions outpace nation, while West and South fall behind

The nation’s regional rent growth leaders continue to maintain their stronghold. The Midwest posted annual rent growth of 2.5 percent, while the Northeast stayed close on its heels with 2.2 percent.

At the other end of the scale, the West saw the steepest decline. Although a few key markets in the West outperformed the nation, the region saw the greatest decline overall, with asking rents falling 1.3 percent. The South, which has struggled to stay in the black in the post-pandemic supply boom, barely retained positive rent growth, with rents increasing by only 0.2 percent overall.

San Francisco retains top spot on rent growth charts

At the market level, rent growth trends remained similar to the performance seen in August. San Francisco continues to lead the nation with rent growth far outpacing the national average. The San Francisco market saw rents increase 6.1 percent year over year, followed by neighboring San Jose with 3.8 percent and Chicago also at 3.8 percent. Norfolk, Virginia came in close behind San Jose and Chicago, with rent growth of 3.1 percent.

Overall, Sun Belt and Mountain West markets have seen the greatest softening.

With a year-over-year decline of 4.4 percent, the Austin market remains at the bottom of the chart, a position it has held since late 2023. Austin is followed by Denver, where rents have declined by 3.8 percent. In Phoenix and San Antonio, rents have dropped by 2.9 percent.

Explore more multifamily insights

For more analysis of the multifamily market, watch the mid-year outlook with CoStar’s Connor Devereux: